Invest in physical gold, silver, platinum and palladium in an Individual Retirement Account IRA

By requesting your free investor kits, you agree to the terms of our Privacy Policy and authorize our free guide fulfillment partners or someone acting on their behalf to contact you in order to arrange the shipping of your investor kits. Our experience with each company was positive overall. By creating an account, you are agreeing to the Terms of Service and the Privacy Policy. Gold IRAs tend to be more expensive than traditional IRAs, but they offer significantly more convenience and services. Portfolio InsuranceIncluding gold and silver in an investment portfolio can act as insurance against systemic risks or unexpected market shocks. The next step is to fund the account with a contribution subject to contribution limits, of course, a transfer, or a rollover from a qualified plan, such as 401k, 403b, or 457 plan. To make sure they don’t break the rules, clients should trust professionals who can help them through the process. American Hartford Gold clients get a 100% satisfaction guarantee and a money back guarantee within seven days of receiving their gold. Licensed in Massachusetts and New York.

Learn

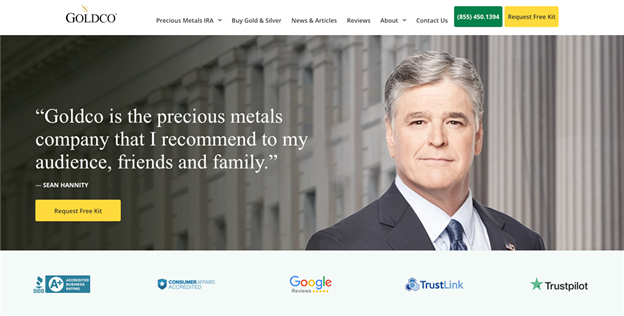

Inheritance taxes are based on assets that have been passed down from generation to generation. Invest in Your Financial Future with Birch Gold Group Today. Experience the Brilliance of GoldCo: Invest in Your Dreams. GoldCo offers a wide range of IRA approved silver coins and bars to meet the needs of its customers. On the C SPAN Networks:Ira Silver is a Chief Economist for the J. However, they can’t keep them at home. The company’s experienced staff provides knowledgeable advice about the best gold IRA investments, as well as assistance in setting up and managing a gold IRA. Gold, Silver, and Platinum IRA 4. Investors can have confidence in silver’s value because of its use in numerous areas of society. Schedule a call with anIRA Counselor. Though the educational resources on their website are minimal, they always have a customer support representative who is ready to answer any queries that are not directly answered on the website.

Invest In Something You Can Hold

The value of a gold coin will increase as the value of gold increases. If you are not sure of what you should invest in, the experts on Goldco’s team would be happy to assist you and offer any tips and advice to help you in your decisions. These can include popular gold coins such as the American Gold Eagle, Canadian Gold Maple Leaf, and South African Krugerrand, as well as gold bars and rounds from reputable mints and refineries. Even though gold and silver IRAs are convenient for many clients, it doesn’t mean they’re the ideal option for everyone. Invest in Your Future with Birch Gold Group. Buy as much gold as you want after prices have dropped. 5 grams to 50 grams in weight. There are several reasons why you might reported choose to open a self directed precious metals IRA with us at Accuplan. Take into consideration these important points.

References

Equity Trust Company is a directed custodian and does not provide tax, legal or investment advice. Overall, investing in a Silver IRA is a great way for many investors to save for retirement while also providing some protection against market volatility. Their knowledgeable staff provides customers with personalized guidance to ensure that their gold investments are tailored to their individual needs. You can keep them at home with you, or in a secure, fully guarded depository. What this tells us is that money right now is all too easily swayed by the movements of a volatile economy. Goldco has a strong reputation with the Better Business Bureau and the Business Consumer Alliance. If you pay your fees by check, you will need to pay for the transaction fees and a year of recordkeeping fees in advance. During this initial call, you will speak with an agent who will explain the basics of an IRA and answer any questions you may have. These are the requirements for silver. Terms of Use Privacy Policy. When paired with other investment options, precious metals are an options to diversify your retirement portfolio. Working with a reputable precious metals IRA provider can help you navigate the complex world of precious metal investing and ensure that your investments meet IRS guidelines and are properly managed for the long term. Owning and storing actual precious metals in a self directed IRA is an important and straightforward step toward true diversification of your investments. They offer a wide variety of options and make the process of setting up and funding your account straightforward.

Which precious metals products are IRA approved?

Discover the Benefits of Investing with Oxford Gold Group Today. All these experts help clients create a better retirement nest by creating new IRA accounts and facilitating the rollover of retirement funds into precious metals portfolios. Choosing the right gold firm can mean the difference between success and failure as a gold owner. Assets under custody as of 1/31/2023. Don’t wait any longer, invest today to ensure a secure financial future. But this would be convenient on your part if the company does have international transactions since you can receive your gold even if you are living overseas. Monday to Friday: 04:00 to 16:45 EST. With their silver IRA services, investors can rest assured that their investments are in safe hands. In its over two decades of operation, the company has set itself as a reputable company, especially with endorsements from personalities such as Ben Shapiro and Steve Bannon. A gold IRA works a lot like a traditional IRA. “Sandra was very helpful and attentive to our needs. 10 ounce; 1 ounce silver coins; certain platinum coins; and gold, silver, palladium, and platinum bullion that meet or exceed the fineness requirements of a regulated futures contract. A rollover or direct transfer is a non taxable event.

Choose a Depository

Choosing the best silver IRA business is crucial. 9/5 Stars From 294 Reviews. Noble Gold offers gold, silver, platinum, and palladium for its precious metals IRAs. This type of service would provide peace of mind knowing that if something does happen to your holdings, you’ll have some form of financial recourse available should you need it. Additionally, you can check us out on Facebook, Instagram, Pintrest, Twitter, and You Tube. Investing in precious metals can be beneficial, but you should know the risks and potential pitfalls. To take distributions, you’ll need to be at least 59. Their commitment to excellence and customer satisfaction make them a top rated provider of silver IRA services. We use cookies including third party cookies such as Google to remember your site preferences and to help us understand how visitors use our sites so we can improve them. Orion recommends you store precious metals at a local Brinks or Delaware Depository location.

Watch FREE, Live Streaming of Local News and Weather 24/7

The earliest types of. Founded in the 1970s and still family owned, it is one of the oldest and most respected names in the gold industry. You can purchase and hold four types of precious metals in your IRA. Augusta has a great buyback program and relies on Delaware Depository’s widely dispersed vault locations to meet the storage needs of their customers. There are several ways to buy silver for your IRA, including a self directed IRA or rolling over funds from another IRA. However, in order to set up a gold and silver IRA, one needs to find a reputable broker or custodian who can handle the account. In addition to being able to invest in a wider range of assets, another benefit of owning a self directed IRA is that there are no taxes on capital gains until distributions are made from the account. However, Patriot Gold’s website lacks information on costs, account requirements, and other details, so it’s best to call the company and inquire directly. Pricing for Landlord Software.

MEDIA

1032 allows storage at TPM Depository. Otherwise, gold IRAs are subject to the same tax benefits, limitations, and withdrawal penalties as traditional IRAs. This coin is available in 1/2oz. The entire team at RC Bullion is committed to making sure that every aspect of a transaction is satisfactory to their clients. It is crucial to note that the fee storage cost also includes insurance as well as the guarantee that your investments are separately stored from the precious metals of other people. Their experienced staff is dedicated to helping you make informed decisions about your investments. All markets have risks associated with them. 4885 Convoy StreetSan Diego, CA 92111858 505 0172Fax: 858 505 9807. For more information please visit our License Page. Service: 866 928 9394. Meanwhile, the financial system looks like trouble. The provider will then purchase and hold the silver coins and bars in a secure vault on your behalf. We’ll ship your purchased coins or bars to the depository to help keep them insured, safe, and secure.

Understanding A Gold and Silver IRA Rollover

Once you get an account set up, you will be able to invest retirement funds directly into gold and silver coins and bullion. Goldco, a brokerage company, works with trusted custodians to secure your assets. The company stands out among the best gold IRA companies for its commitment to helping customers achieve their financial goals. Via a transfer, a rollover, or a cash contribution. If you have a TSP and are still working, you might be eligible for a partial gold IRA rollover if you’re above the age of 59. With decades of experience, Advantage Gold is an expert in gold investments, offering a wide selection of gold coins and bars. Per their website, “The Texas Bullion Depository has been designed to ensure the depositor sleeps well at night knowing their valuable precious metal assets are properly accounted for and protected. Discover the Benefits of GoldBroker: Invest in Gold with Confidence. This option is not common among Gold IRA companies so if this is something you’re interested in, take some time to find which ones offer this service. However, the products they buy have to abide by the IRS rules.

Fund Your Account

Identify your wealth building goals and discover your personalized strategy by answering a few quick questions. Due to their limited quantity and lower volatility than fiat currencies, they are currently in high demand. $10,000 account minimum. Terms of Use Privacy Policy Site Map. Palladium for inclusion in an IRA must have a minimum fineness of. Historical Chart Center. When looking for Gold IRA loan lenders, it’s crucial to do thorough research to determine their reputation and credibility. Is an Equal Housing Lender. TUH Union Health Silver+ Family, $232 per month.

Apr 19, 2023

You will also receive a confirmation call from the confirmation department to assure you of your purchase. Once you’ve established your new Self Directed IRA, you will simply call your investment plan provider and verbally initiate the rollover. Your consent to such contact is not required for purchase. They allow investors to diversify their portfolios and hedge against risk, making them an attractive investment choice for those looking to secure their retirement savings. Noble charges annual fees of $80 and storage fees of $150 per year, which include both insurance and housing. Oxford Gold Group Cons. Retirement Living independently researches companies, and we use editorial discretion to award companies with special recognition i. The best gold IRA companies will have a team of knowledgeable advisors who can help investors make informed decisions. Gold Alliance offers a variety of coins and bars in different sizes and weights, but the website does not provide pricing information. So, consider these brands when deciding on a Gold IRA provider, and choose the one that best meets your investment needs. You are encouraged to talk to your financial advisor before making any investment decisions. It can be seen as highly volatile with greater returns yet more significant swings—frequently providing exposure to industries like tech/communications that benefit from digital infrastructure with increasing electricity demands—for example. Get recognition as a TOP Business.

Lifetime Support

The current law allows for both transfers from Individual Retirement Accounts as well as rollovers from qualified retirement plans, such as 401k, 401a, 403b, 457, Thrift Savings Plan TSP and annuities. There are a number of bullion options that are IRA approved, meaning that they are guaranteed to be legal for IRA investment opportunities. A: To open a silver IRA, you must be at least 18 years old and have a valid Social Security number. Silver IRAs have been growing in popularity as silver has attracted increasingly more attention over recent years. Only when you retire and withdraw your funds will they be taxed. 6 The rise of real estate as a real world securitized asset has begun with New Silver and MakerDAO. Equity Trust Company is a directed custodian and does not provide tax, legal or investment advice. By clicking ‘Request Info’, I have read and agree to the Privacy Policy. Treasury Department, along with certain foreign coins. Aside from the number of precious metals you wish to purchase, they come with minimum investment costs, storage fees, custodian fees, and more. With their extensive experience and commitment to customer service, they are the perfect choice for those looking to diversify their portfolios and prepare for retirement. All these experts help clients create a better retirement nest by creating new IRA accounts and facilitating the rollover of retirement funds into precious metals portfolios. The availability of metals is an important consideration in many industries. Investors with a medium sized account $50,000 or larger should be careful to always get fees in writing before making a transfer into silver.

Take Us With You

The higher your investment into the gold IRA, the lower your fees. If you’re unsure whether gold or other precious metals are right for your investing needs, you can request a free investment guide through Oxford Gold Group. First off, let’s look at what makes up an excellent gold IRA company. In any financial conditions, using a retirement account to invest in gold and other precious metals can reduce or eliminate your taxes on any profits. When the metal is distributed from the depository, it will be the same size bar, from the same refiner as the bar that was originally deposited. Smaller bullion bars other than 100 ounce gold and the sizes listed above must be manufactured to the exact weight specifications. Many investors choose to diversify retirement portfolios with alternative assets that are not correlated to the stock market. Their range of precious metal IRA options allows investors to diversify their portfolios and safeguard their wealth against economic uncertainties.

Disclaimer: The information provided on this page is for educational purposes only Refer to a professional for investment advice In some cases, we receive a commission from our partners Opinions are always our own

You can then choose the types and amounts of silver you wish to purchase. The Business Consumer Alliance awarded them with a AAA rating, and they earned an A+ qualification from the BBB. The company even offers rare, numismatic coins as part of its portfolio, as well as traditional physical gold and silver coins and bullion. In terms of price, it will be close to the most recent market value. Why it stands out: You can also roll over existing retirement accounts into a gold IRA — or a silver, palladium, or platinum IRA, if you choose — at Birch Gold Group. Their commitment to customer service and competitive pricing makes them an industry leader. All silver and gold rounds and bars minted by the Golden State Mint are IRA Approved/ Certified. They have a number you can call between the hours 7 am to 4 pm PST to make all your inquiries. Trustpilot Gives Augusta 5 Stars. Depending on the size of the account, there may also be an annual administration or custodial fee ranging from $50 to $150 per year. Since your funds reside within the IRA, we must contact your custodian for payment. YOUR CONTINUED USE OF THE WEBSITE AFTER A CHANGE IN THE EFFECTIVE DATE OF THIS PRIVACY POLICY CONSTITUTES YOUR ACKNOWLEDGEMENT AND ASSENT TO THE UPDATED POLICY.

DISCLAIMERS

Additionally, because no money is withdrawn and given to you, the funds are not taxed by the IRS. They have developed partnerships with the top gold IRA custodians, IRS approved vault depositories, and offer some of the lowest gold IRA fees in the business. Annual fees start at $95, and there is no charge for buybacks. Advantage Gold emerged as one of the leading Gold IRA providers since its establishment in 2014. Therefore, we strongly recommend that you inquire about the terms and conditions of the custodian fee because these fees can cost you thousands of dollars. Mountain West IRA, Inc. It comes in four different sizes: 1 oz, 1/2 oz, 1/4 oz and 1/10th oz. You will also select which of the three approved depositories you would like your precious metals stored at.

About the Royal Canadian Mint

This is simply unacceptable in today’s uncertain economic landscape. Feel free to share your thoughts in the comments section below. Join Patriot Gold Club Now and Experience the Benefits. For over 10 years, Direct Bullion has assisted clients who are looking to diversify their funds in precious metals. These coins are considered rare and valuable due to their historical significance, rarity, and unique features. “Where can I find reliable loans for investment properties. To evaluate the legitimacy and reputation of gold and silver IRA companies, investors can consider several factors.

:fill(white):max_bytes(150000):strip_icc()/Advantage_Gold-9de94006f9504fe48aca4e52d9ade4fe.jpg)